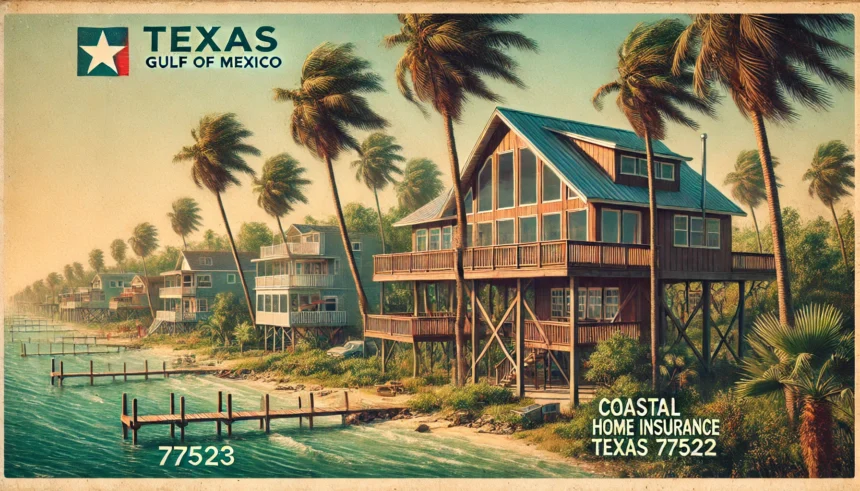

Coastal Home Insurance Texas 77523 is essential for homeowners in Baytown and nearby areas. Living close to the Gulf of Mexico comes with unique challenges, including risks of hurricanes, flooding, and windstorms. Standard homeowners insurance typically does not cover all these risks, making it crucial to secure additional coverage tailored to coastal properties.

Key policies to consider include windstorm and hail insurance, provided by the Texas Windstorm Insurance Association (TWIA), and flood insurance, available through the National Flood Insurance Program (NFIP) or private insurers. These coverages ensure protection against the frequent and severe weather events common in this region.

Homeowners can also take proactive measures to reduce risks and lower premiums, such as installing storm-resistant windows, elevating homes, and complying with local building codes. By combining the right insurance policies and safety upgrades, you can protect your property and enjoy peace of mind in Baytown’s beautiful coastal setting.

Challenges of Coastal Living

Baytown, located on the Texas coast, faces unique challenges due to its vulnerability to hurricanes, tropical storms, and flooding. These natural hazards can cause severe damage to homes, so it’s important to understand the insurance coverage you need to stay protected.

Natural Hazards:

- Hurricanes and Tropical Storms: High winds, heavy rains, and storm surges are common in the region, often causing significant damage to homes.

- Flooding: Coastal areas like Baytown are prone to flash flooding due to heavy rainfall, especially during storm seasons.

- High Winds: Windstorms and hail can cause severe damage to roofs, windows, and other parts of the home.

Due to these risks, homeowners in Baytown need specialized insurance policies to cover windstorm and flood damage, which are often excluded from standard home insurance.

Key Types of Insurance for Coastal Homes

To adequately protect your home in a coastal area like Baytown, you need more than just standard homeowners insurance. Here’s a look at the types of coverage you’ll need:

Standard Homeowners Insurance

A typical homeowners policy covers basic risks such as:

- Fire damage

- Theft or vandalism

- Liability for accidents on your property

However, most standard policies do not include coverage for flooding or windstorm damage, which are common issues in coastal regions.

Windstorm and Hail Insurance

Windstorm and hail insurance is specifically designed to cover damage caused by high winds and hail, which are frequent during hurricanes and other storms in coastal Texas. In Baytown, this coverage is often provided by the Texas Windstorm Insurance Association (TWIA), a state-backed program.

Flood Insurance

Flood insurance is crucial in coastal areas like Baytown, where homes are at higher risk of flooding due to heavy rains and storm surges. Flood damage is typically not covered under standard homeowners insurance, so it’s important to purchase a separate flood policy. You can obtain flood insurance through the National Flood Insurance Program (NFIP) or private insurance companies.

Understanding the Texas Windstorm Insurance Association (TWIA)

The Texas Windstorm Insurance Association (TWIA) plays a critical role in helping homeowners in coastal areas obtain windstorm and hail coverage. Here’s what you need to know about TWIA:

What is TWIA?

TWIA is a state-backed program that provides wind and hail insurance to homeowners in Texas coastal areas. It was established to help residents who might have difficulty obtaining private insurance due to the high risk of wind damage.

Who Needs TWIA?

If you live in a coastal area like Baytown, you’ll likely need windstorm and hail coverage through TWIA. This is especially true if you live in one of the designated high-risk zones.

How to Qualify for TWIA

- Windstorm Inspection: Your home will need to pass an inspection to ensure it meets certain building standards to withstand wind damage.

- Flood Insurance Requirement: In some cases, TWIA may require proof of flood insurance before providing windstorm coverage.

How to Apply

To obtain a TWIA policy, work with a local insurance agent familiar with coastal coverage. They can help you navigate the application process and ensure your home is properly insured.

Importance of Flood Insurance

In coastal areas, flood damage can be just as devastating as wind damage, if not more. That’s why flood insurance is so important in Baytown. Here’s why you need it:

Why Standard Insurance Isn’t Enough

Standard homeowners insurance excludes flood coverage, meaning you need a separate policy to protect your home from flood-related damage. This is particularly important in flood-prone areas like Baytown.

Flood Risk in Baytown

Due to its coastal location, Baytown is susceptible to flash flooding, especially during hurricanes or heavy rainstorms. Even minor flooding can cause significant damage to homes and possessions.

Flood Insurance Options

- National Flood Insurance Program (NFIP): This federal program offers basic flood coverage, typically covering up to $250,000 for the structure and $100,000 for personal belongings.

- Private Flood Insurance: Private insurers may offer higher limits and additional coverage options, providing more comprehensive protection for homes in flood-prone areas.

Flood Insurance Waiting Period

Keep in mind that flood insurance often comes with a 30-day waiting period before it becomes effective. Be sure to secure your policy well in advance of storm season to ensure you are covered.

Additional Insurance Considerations

When securing insurance for your coastal home, there are a few additional considerations to keep in mind:

Rebuilding Costs

Ensure your policy covers the full cost to rebuild your home to meet current building codes, especially those designed to withstand windstorms and floods.

Deductibles

Coastal insurance policies often have separate deductibles for wind and hurricane damage. Make sure you understand these deductibles, as they can be higher than standard deductibles.

Bundling Policies

Consider bundling your homeowners, auto, and flood insurance policies. Many insurance providers offer discounts for bundling, which can help lower your overall premiums.

How to Lower Insurance Premiums

Insurance costs in coastal areas can be high, but there are steps you can take to lower your premiums:

Home Improvements

- Storm Shutters & Impact-Resistant Windows: Installing storm shutters and impact-resistant windows can help protect your home and may result in lower premiums.

- Elevating Your Home: Homes built above base flood elevation are less likely to flood, and this can help lower your flood insurance premiums.

Building Code Compliance

- Wind-Resistant Features: Homes built to wind-resistant standards may be eligible for discounts on windstorm insurance through TWIA.

Disaster Preparedness

Having an emergency plan in place and being proactive about protecting your home can demonstrate to insurers that you’re taking steps to mitigate risk, which could lead to lower premiums.

Choosing the Right Insurance Provider

When shopping for coastal home insurance in Baytown, it’s important to work with an agent who understands the specific risks of the region. Here’s what to look for:

Work with Local Agents

Local insurance agents are familiar with the risks associated with living on the Texas coast and can help you find the best coverage for your needs.

Compare Policies

Make sure to compare policies from different providers to find the best coverage at the most affordable price. Don’t hesitate to ask questions about what is covered and any exclusions that may apply.

Recommended Providers

Some reputable providers in the Baytown area include:

- TGS Insurance Agency

- Guardify Insurance Group These companies specialize in coastal home insurance and can help you secure the right coverage.

Preparing for Disasters

It’s not just about having the right insurance. It’s also important to be prepared in case disaster strikes.

Create a Home Inventory

Keep an updated list of your belongings with photos or videos. This can help you with insurance claims in the event of damage.

Store Important Documents Safely

Keep copies of your insurance policies, ID documents, and other important papers in a safe, waterproof container.

Have an Emergency Fund

In case of high deductibles or temporary living expenses if your home becomes uninhabitable, it’s a good idea to have an emergency fund in place.

Conclusion

Coastal Home Insurance Texas 77523 is crucial for protecting your home and belongings from the unique risks posed by living near the Gulf of Mexico. With proper windstorm, flood, and homeowners coverage, you can ensure your home is protected from the financial impacts of hurricanes, flooding, and other natural disasters. Be proactive, work with local agents, and take steps to safeguard your home from coastal hazards.

By understanding your insurance needs and taking the right precautions, you can enjoy the beauty of coastal living while protecting your most valuable asset—your home.

FAQs

What is the Texas Windstorm Insurance Association (TWIA)?

The TWIA provides wind and hail coverage for homeowners in coastal Texas areas, especially for those unable to obtain insurance through private insurers due to high risks.

Does homeowners insurance cover flooding in Baytown?

No, standard homeowners insurance typically doesn’t cover flood damage; separate flood insurance is required, available through the NFIP or private insurers.

How can I lower my coastal home insurance premiums?

You can lower premiums by installing storm-resistant features, elevating your home, and bundling insurance policies for discounts.

How long does it take for flood insurance to take effect in Texas?

Flood insurance generally has a 30-day waiting period before it becomes active, so it’s important to buy it well before hurricane season.

Do I need flood insurance in Baytown, Texas?

Yes, Baytown is a coastal area with high flood risk, so flood insurance is crucial for protecting your home from potential flood damage.

Article Recommendations

Money 6x Investment Trusts: Your Guide to Smarter Diversification

PedroVazPaulo Real Estate Investment: Your Guide to Profitable Properties

Money6x.com Make Money: Your Ultimate Earning Platform

Traceloans.com Mortgage Loans: Compare Rates and Find Your Best Option